Econometric Modeling for Macroeconomic Policy

- Date 2012-08-01 04:49

- CategoryResearch and Education

- Hit1592

On June 22nd, Christopher A. Sims, Professor of Economics and Banking at Princeton University and a 2011 Nobel laureate in Economic Sciences, delivered a lecture at the KDI School about economic policy modeling in the wake of the crisis.

Prof. Sims started the lecture by reviewing some well-publicized claims that economics has been too mathematical, insufficiently philosophical, overly reliant on assumptions of rationality, over Keynesian, and too dependent on New Keynesian Dynamic Stochastic General Equilibrium (DSGE) Models.

Prof. Sims indicated that most of these claims came from the groups that were unhappy with the pre-crisis intellectual hierarchy in economics, such as scholars in other social science fields, advocates of minority schools within economics, or people in less popular subfields of economics. “This doesn''t necessarily mean their claims are invalid,” he admitted. “It’s just that those counterarguments should not be considered plausible simply because we’re experiencing an economic crisis.”

Prof. Sims pointed out that those who are criticizing the previous framework are failing to provide any alternatives. For lack of better options he is trying to defend the DSGE policy models. “The current models are essentially the only locus for research on policy-relevant, statistical models of data,” he asserted. He continued that they are where the best research is being carried out to amend financial imperfections.

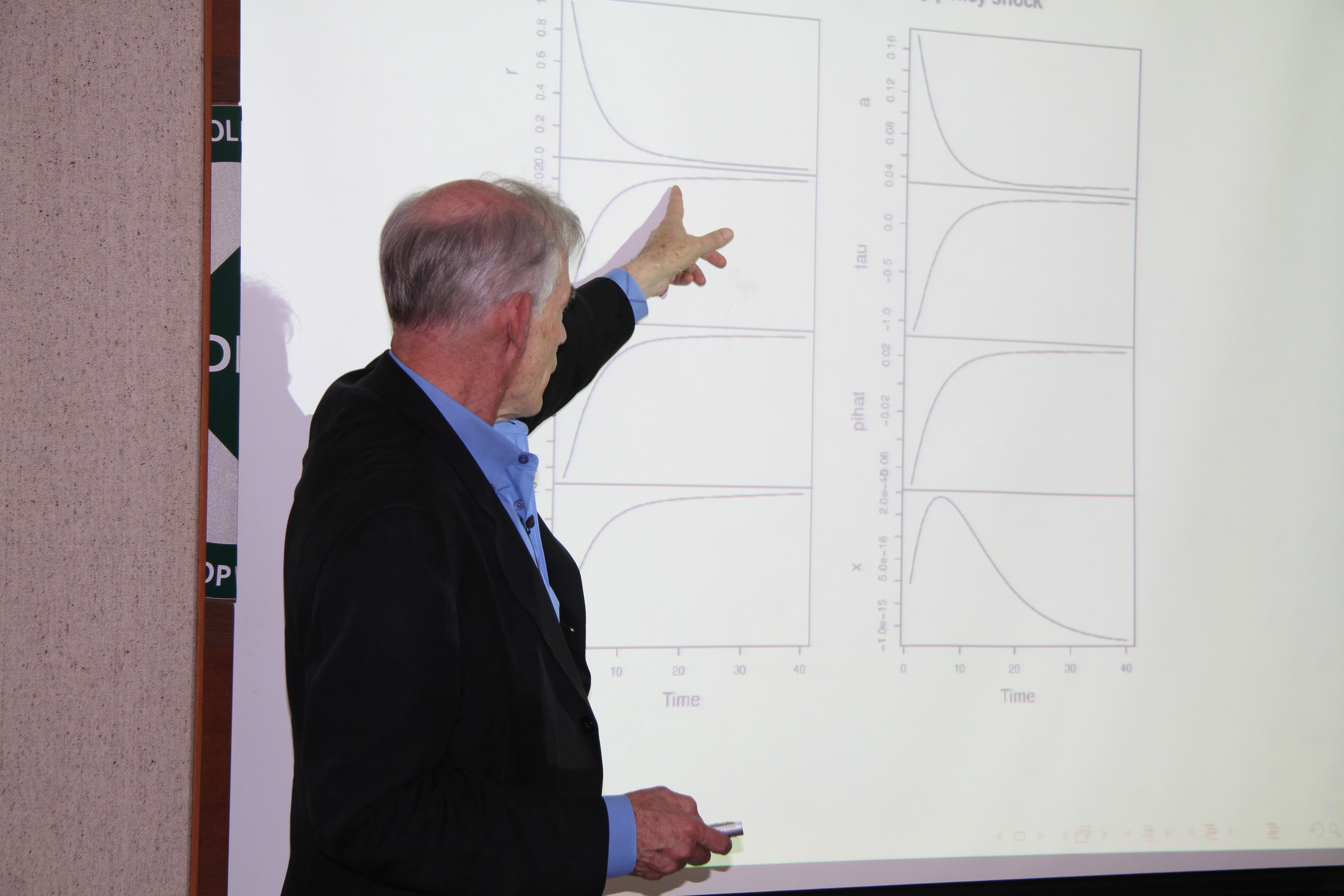

He then explained his econometric model with the particular adjustments to the financial shocks. In his new model, the monetary policy reaction function responds more than proportionally to inflation; inflation expectations move exogenously and in response to the size of the debt; and there is long government debt (consols) that allows interest rates and the price level to absorb fiscal shocks.

After laying out the model equations and making predictions on three types of shock responses (expectations, monetary policy, and fiscal shock), he referred to the continued struggle of the European Union and noted how unsustainable the central banks might become when they lose control of the price level with a higher default risk. Prof. Sims concluded the lecture saying that central banks around the world may be able to predict future financial shocks and coordinate appropriate reactions by adopting his new model.

By Juan David Munoz (2011 MPP, Colombia)

Related News

-

Research and Education9 days ago

Republic of Korea Economic Bulletin, May 2024#KDI #Economic #KDISCHOOL #kdischool #Economic Bulletin #Research

-

Research and Education37 days ago

Republic of Korea Economic Bulletin, April 2024#KDI #Economic #KDISCHOOL #kdischool #Economic Bulletin #Research

-

Research and Education65 days ago

Republic of Korea Economic Bulletin, March 2024#KDI #Economic #KDISCHOOL #kdischool #Economic Bulletin #Research