[2020 Alumni Essay] Reaching MSMEs, Protecting from Pandemic Impacts

- Date 2020-10-27 04:44

- CategoryResearch and Education

- Hit1790

2020 INTERNATIONAL ALUMNI ESSAY CONTEST WINNERS'' ESSAYS

Reaching MSMEs, Protecting from Pandemic Impacts

IMBIYONO, Yanuar (2015 MPP, Indonesia)

After spreading in China at the end of 2019, COVID-19 spreads widely in 215 countries around the world (Worldometers.info, 2020). The pandemic creates global domino effects on social, economic, and financial aspects. Policies to flatten the transmission curve has caused the decline of the world economic performance sharply, global economic growth projection is -3%, while the potential global Gross Domestic Product (GDP) lost in 2020-2021 is USD 9 trillion (IMF, 2020).

In Indonesia as of June,18th 2020 there are 42,762 total cases, 2,339 total deaths, 16,798 total recovered (Ministry of Health, 2020). The easy and fast transmission of COVID-19 besides creates a health crisis by the absence of vaccines, drugs, limited types of equipment, and medical personnel; it’s affected on social, economic, and financial aspects as well. The projection of economic growth in 2020 in very extreme conditions can reach -0.4% (IMF, 2020). Based on the government’s prediction, there will be 5.23 million new unemployment and 4.86 million Indonesian will enter a poor level.

<Picture of one Micro Business in Indonesia as a unit to support during the pandemic of COVID-19>

<Picture of one Micro Business in Indonesia as a unit to support during the pandemic of COVID-19>

To reduce pandemic impacts on economic and social aspects, the government has prepared comprehensive policies; one of the policies is to support the MSMEs as the most affected sector. MSMEs play an important role in Indonesia, in 2018, there were 64.2 million MSMEs and contributed around 60.3% of total GDP, absorbed 97% of the total workforce and 99% of total employment (Ministry of Cooperatives and SMEs, 2018).

As Head of Performance Management Section of the Investment Management System Directorate under the Ministry of Finance, the writer and team got a very challenging assignment to formulate in a very short time -less than two months- schemes to support approximately 60.66 million of MSMEs.

To formulate the best schemes, the writer relearned the Theory and Practice of Political Economy course by Professor Park Hun Joo, when studied for Master Degree at KDI School, one of the lectures was about Small Business in Korea, Japan, and Taiwan, the writer can conclude that economic policymaking in East Asia was formed by political exigencies and the choices of the regime coalition.

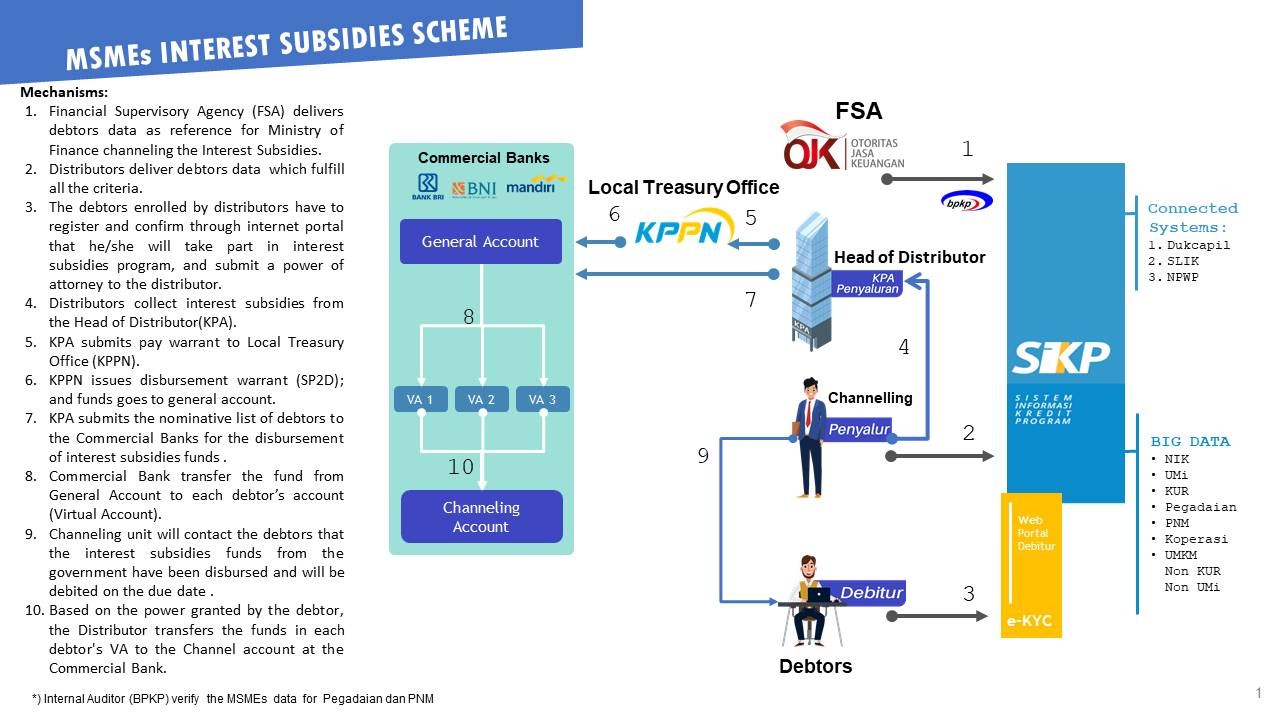

<MSMEs Interest Subsidies Scheme (Minister of Finance Regulation Number 65/PMK.05/2020 on June 5th, 2020)>

<MSMEs Interest Subsidies Scheme (Minister of Finance Regulation Number 65/PMK.05/2020 on June 5th, 2020)>

The writer also involved in deep discussions with KDI School alumni and gained some fruitful information such as currently Ghana has allocated stimulus programs for SMEs namely COVID-19 Alleviation Program (CAP), Myanmar is implementing COVID-19 Economic Relief Plan (CERP), while Pakistan is preparing support through the Economic Coordination Committee (ECC). Another insightful information came from the KOICA web seminar series about ROK’s Experiences in Tackling COVID-19 in economic policies, where the Ministry of SMEs and Start-ups provide EUR 1.2 billion to SMEs and self-employed.

<Picture of discussion through video conference with KDI School alumni to discuss their countries'' support to SMEs.>

<Picture of discussion through video conference with KDI School alumni to discuss their countries'' support to SMEs.>

<KOICA Invitation to web seminar series about ROK’s Experiences in Tackling COVID-19>

<Picture one of the meetings with MOF employees through Video Conference application to formulate the schemes.>

<Picture one of the meetings with MOF employees through Video Conference application to formulate the schemes.>

Based on the valuable insights above, the writer and team have formulated schemes to support MSMEs through Interest/Margin Subsidies passed by Minister of Finance Regulation Number 65/PMK.05/2020 on June 5th, 2020, as follows:

- Principal installments postponed for debtors of Kredit Usaha Rakyat, Ultra Mikro, and Mekaar programs, total State Budget allocation for this scheme is USD 2.4 billion.

- Interest subsidies for debtors of Rural and Commercial Banks, and Financing Companies with maximum loan USD 35,000 by 6% for the first 3 months and 3% for the next 3 months, and debtors with maximum loan USD 35,000 up to USD 704,000 by 3% for the first 3 months and 2% for the next 3 months.

- Interest subsidies no higher than 25% for debtors of government credit program institutions with a maximum loan up to USD 703. Interest subsidies 6% for the first 3 months and 3% for the next 3 months for loans above USD 703 up to USD 35,000, and interest subsidies by 3% for the first 3 months, 2% for the next 3 months for loans above USD 35,000 up to USD 704,000. Total State Budget allocation is USD 20 billion.

The regulation preparation process was exhausting, due to time concern the writer and team usually hold meetings three times a day through video conference, each lasting for two hours at least, with relevant parties such as Commercial Banks, Central Bank, Financial Supervisory Agency, Law Enforcement Institutions such as Auditors, Attorney General, etc.

After all, to reduce the COVID-19 impacts, we have to be willing to cooperate and work harder and smarter to support MSMEs, all the work will pay off when our economic rose during the pandemic as MSMEs performance increases.

Publications:

Media Coverages:

1) https://www.beritasatu.com/ekonomi/632221-pemerintah-beri-subsidi-bunga-untuk-umkm-rp-3415-triliun

Related News

No Contents.